b&o tax rate

In a recent report Brian Riedl a senior fellow at the Manhattan Institute a conservative think tank pointed to the CBOs prediction that. Remit the sales tax with your tax return.

You must also charge your customer retail sales tax based on the sales tax rate for the job location.

. On your tax return report this income under the retailing classification of the business occupation tax BO.

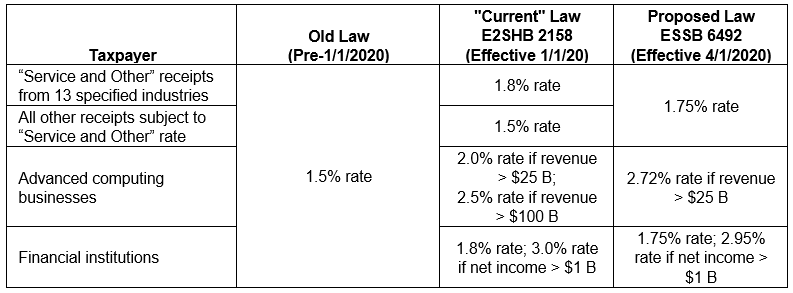

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

A Guide To Business And Occupation Tax City Of Bellingham Wa

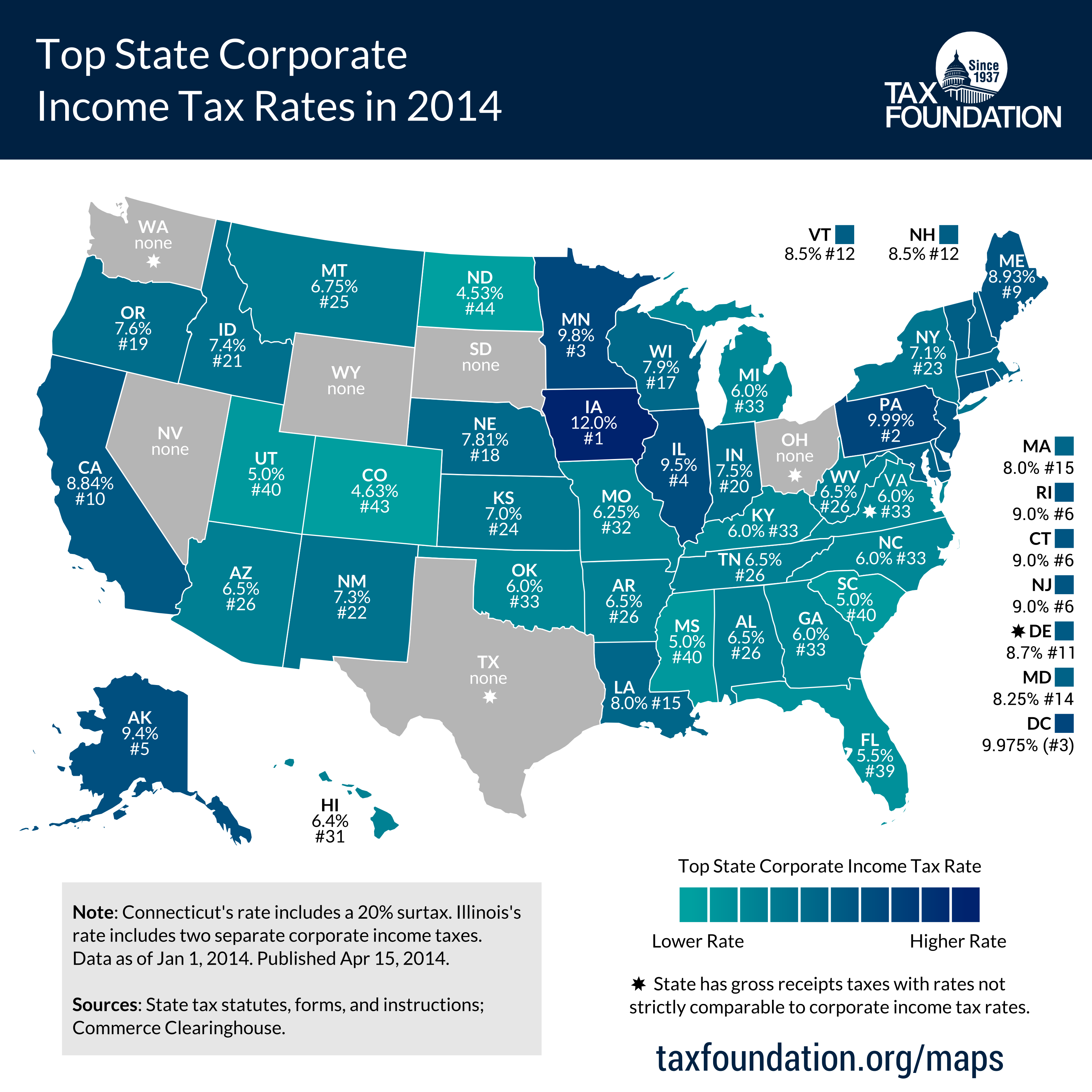

Top State Corporate Income Tax Rates In 2014 Tax Foundation

County Surcharge On General Excise And Use Tax Department Of Taxation

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

The Washington B O Tax Nexus Traps For The Unwary Taxpayer Deloitte Us

The Washington B O Tax Nexus Traps For The Unwary Taxpayer Deloitte Us

Importance Of State And Local Tax Planning Various Types Of Taxes Levied On Business Review Table 1 1 Various Business Transactions Subject To Taxation Ppt Download

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

B O Tax For Auburn Businesses Here S What You Need To Know Auburn Examiner

Explaining Our Analysis Of Washington State S Highly Regressive Tax Code Itep