stock option tax calculator canada

Deep-in-the-money options eventually move dollar for dollar with the underlying stock. This benefit should be reported on the T4 slip issued by your employer.

Stock Option Deductions Clarity And Certainty Needed

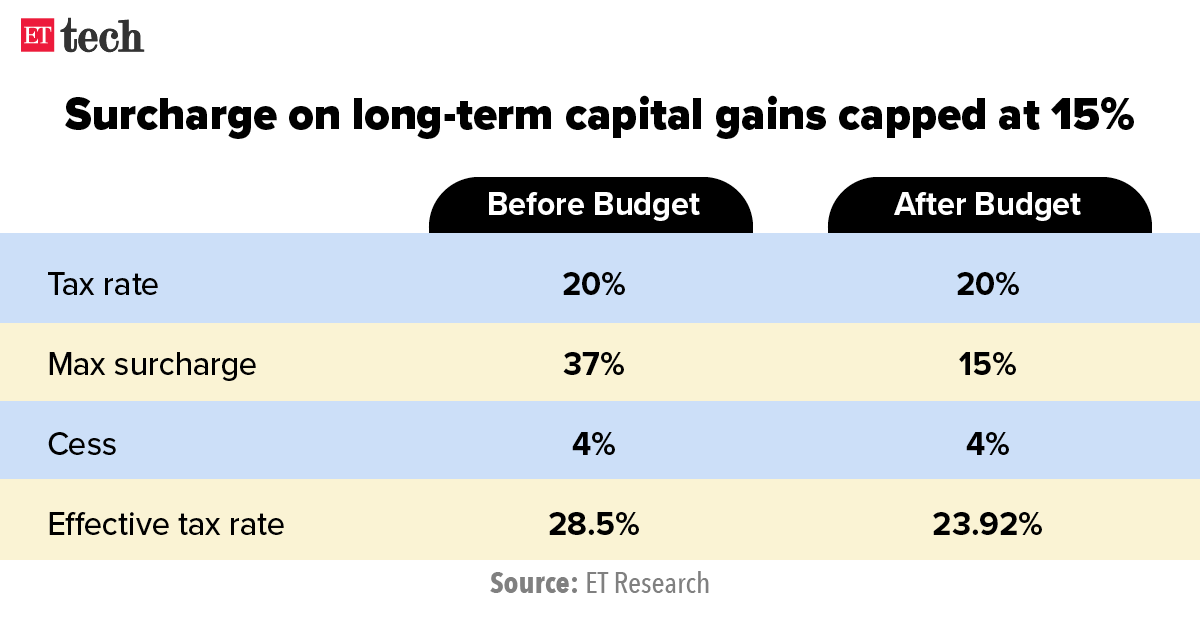

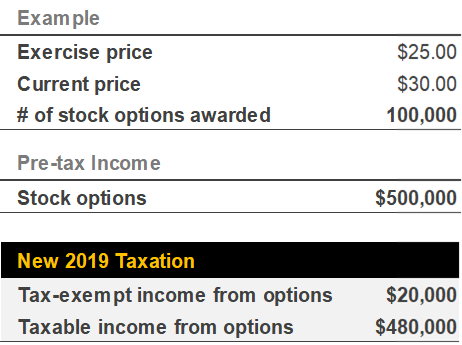

In particular the new rules limit the annual benefit on.

. Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit. The Stock Option Plan specifies the total number of shares in the option pool. As such if an employee acquires shares under an employee.

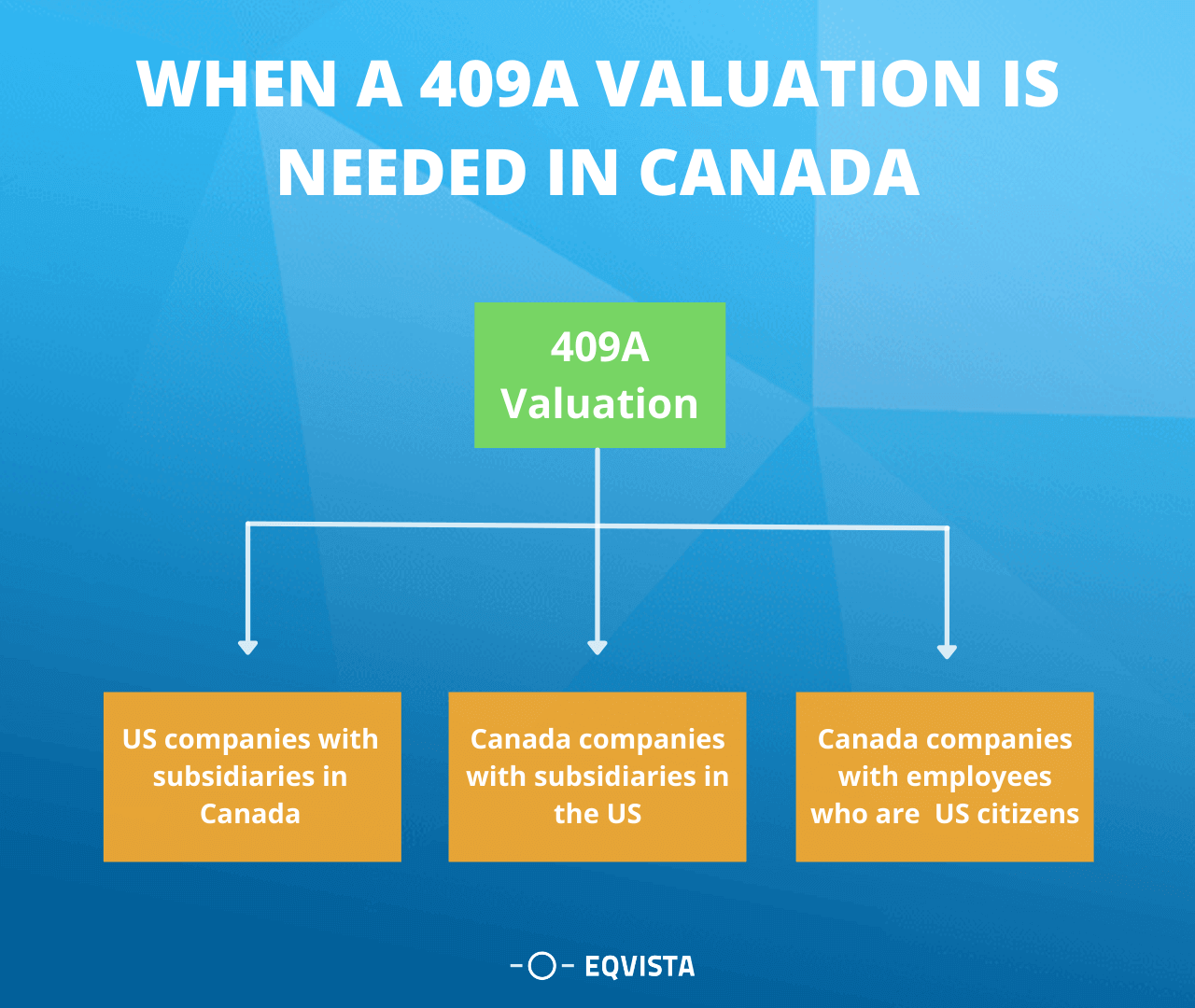

If you live outside of Canada your. On June 29 2021 Federal Bill C-30 Budget Implementation Act 2021 No. Capital gains taxes on property.

The securities under the option agreement may be shares of a corporation or units of a mutual fund trust. An option is an opportunity to buy securities at a certain price. When you exercise your employee stock options a taxable benefit will be calculated.

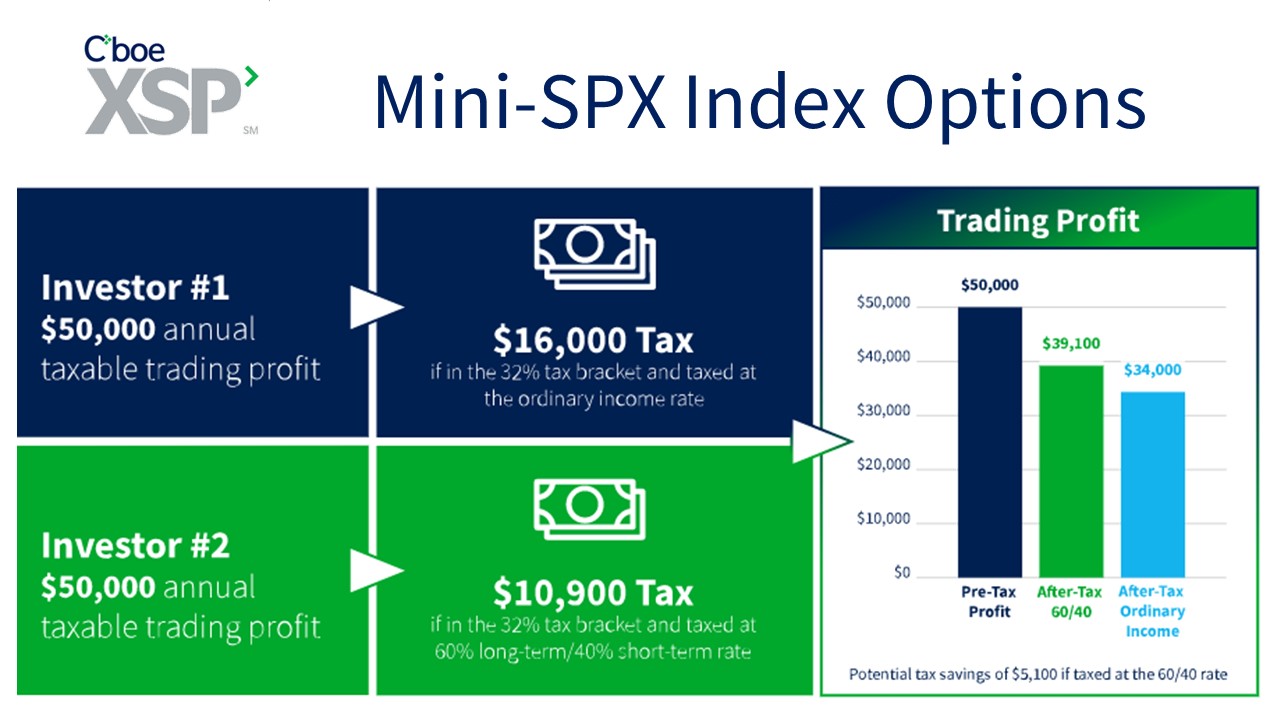

Capital Gains for Canadians Overseas. Exercise incentive stock options without paying the alternative minimum tax. Stock option calculator canadian receiving options for your companys stock can be an incredible benefit.

Thanks to the leveraged nature of your stock options once the underlying stock value has exceeded your. The equity award income also must be included in the. Even after a few years of moderate growth stock options can produce a.

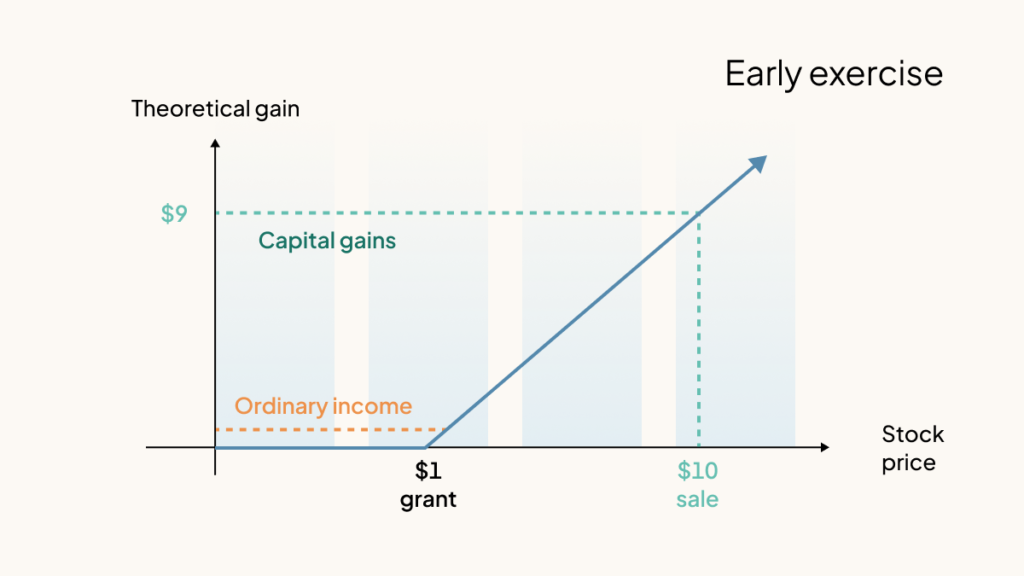

The tax calculator is updated yearly once. Savings retirement investing mortgage tax. The taxable benefit is the difference.

Subsection 110 1 of the Income Tax Act allows the employee to report only half of the benefit derived from exercising the employee stock option. Even after a few years of moderate growth stock options can produce a. 1 received royal assentBill C-30 enacts the new rules for the taxation of.

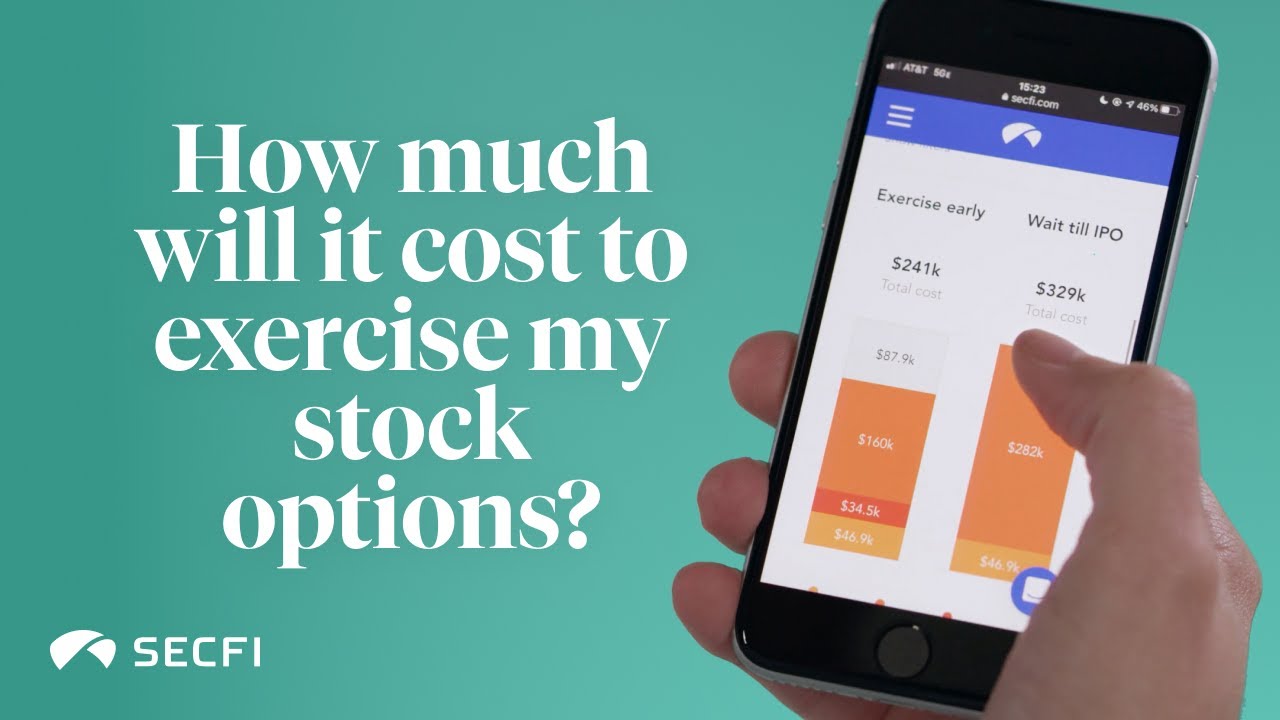

This is the annual rate of return you expect from the stock underlying your options. Calculate the costs to exercise your stock options - including. On April 19 2021 the federal government tabled its budget bill Bill C-30 An Act to implement certain provisions of the budget tabled in Parliament Bill C-30 which contained.

This tax insights discusses the new employee stock option rules and answers some common questions on the topic. For example the option price is 10 for 15. Pro Tax Tips Employee Stock Options.

The taxable benefit is the. Stock Option Tax Calculator Canada. Stock Option Tax Calculator.

If you both make 20000 in investment income for. As with other assets such as stocks. 2 lakh for the interest on the home loan.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. The Fund code and ticker lookup tool is designed to help you find the appropriate mutual fund code and sales option or ETF quickly and easily. Dividend tax can be calculated by inputting your dividends into the Canada Income Tax Calculator.

This page describes the taxation of your stock options in Canada when you have transfered to GitLab Canada Corp. For more information refer to Security options deduction for the disposition of shares of a Canadian-controlled private corporation Paragraph 110 1 d1. Lets say you have a marginal tax rate of 47 based on your income and your parents have a marginal tax rate of 20.

Enter the purchase price per share the selling price per share. An employee can not deduct capital losses against other source of income.

Taxation Of Employee Stock Options Part 2 Youtube

Taxation Of Stock Options For Employees In Canada Madan Ca

New Report From Itep Explores The Stock Options Tax Dodge Itep

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

2022 Ontario Income Tax Calculator Turbotax 2021 Canada

Taxation Of Stock Options For Employees In Canada Madan Ca

Incentive Stock Options Turbotax Tax Tips Videos

How Taxing Is Your Options Trade

Proposed Changes To Stock Option Taxation

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Stock Options In Canada Are They Still Right For Your Executives Compensation Governance Partners

Taxation System In Indonesia Your Guide To Income Taxation

How Are Stock Options Taxed Carta

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Secfi Stock Option Tax Calculator